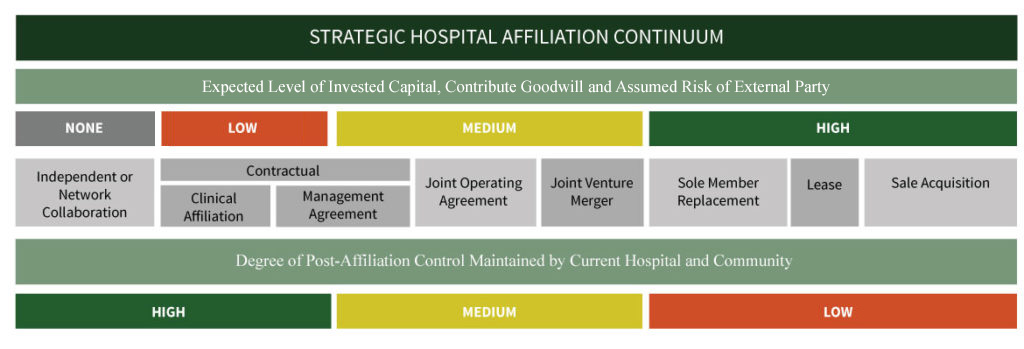

After assessing a client’s unique situation, InnoVative Capital advises hospitals and health systems regarding the alternatives it can pursue in undertaking an affiliation, merger, acquisition, or sale. InnoVative Capital designs clinical and operational collaborations that enhance financial performance and streamline operations, without ceding corporate control. If capital investments for balance sheet augmentation and debt relief are required, asset sales may be explored, or affiliations executed. When circumstances require operational change or institutional sale, InnoVative Capital can represent the hospital or owner during the process.

Products and Services

- Independence Viability Means Testing

- Due Diligence Reviews

- Strategic Planning and Goals Alignment

- Market Studies and Financial Feasibility

- Community Impact Assessment

- Equity Investment and Recapitalization Modeling

- Seller Representation

- Buyer Representation

- Operating and Capital Partner Procurement Platform

- Management and Lease Options

- Affiliation, Merger, and Sale

- Restructure Advisement for Bankruptcy and Creditor Groups

- Hospital Closures